A STATE BANK

The National Liberal Party produced a leaflet last year entitled ‘The Credit Crunch’ which sought to explain how we had got ourselves into todays economic mess. Most commentators agree that it was the private banks greed that encouraged them to over-speculate with their lending. The Government (with cross-party support) had deregulated lending and thus few restrictions were in place to put a brake on any over speculation. Given that the benefiting financiers were making generous contributions to political party coffers was hardly likely to encourage political scrutiny.

To bail out the banks when in trouble the Government underwrote their loans to allow the system to continue trading and thus keep the economy alive. If banks went down then we would too.

The problem was (apart from the buying of patronage via political contributions) that the economy had become reliant upon the banks lending money into society. The bubble of creating ever greater ‘profits’ via interest on those loans was bound to burst. Such profits were created by transferring the earnings of business to the lender and speculator. They had so much money in this way that bankers could afford to pay themselves grossly inflated bonuses much to the disgust of the average working man.

The upshot of the bailout is that the State OWNS MOST OF THE BANKS. Our leaflet went on to suggest that instead of handing these back to private hands that they be conglomerated into a new National (State) Bank. Being not-for profit and run by salaried civil servants they could afford to charge lower fees (preferably rather than an interest rate).

Many Libertarians support Money Reform but worry about swapping one private tyranny with a state one? Below is an article supplied discussing the possibility of maintaining private banks with a state one. We welcome contributions to this debate because like the need for electoral reform, Monetary reform is not if but when?

•

ESTABLISH A STATE BANK

The Nation’s money comes from two primary sources, first the State which prints paper money and mints the coins (and also raises bonds) and second from the commercial banks which provide credit.

Up until the early fifties the ratio of notes and coins to bank-created credit was roughly one to one. In 1948 for instance, the State had issued and spent debt-free into circulation £1.3 billion notes and coins, and the banks had out on interest-bearing loans to their customers £1.4 billion.

The only cost of money created by government is that of minting — a small fraction of its face value. This physical cash is spent into circulation when it is sent to the clearing banks and the government account is credited with its full value.

This is called “seigniorage”. In the old days it was a perk of the Sovereign, hence the name, but in a modern democracy this value accrues to the People, as it is credited debt-free to the public purse.

END THE MONOPOLY OF PRIVATE BANKS

This article proposes legislation to end the virtual monopoly of private commercial banks and to establish a Seigniorage (Seignior) Bank — you could call it a “State Bank” — which will provide a source of debt-free money to the State, enabling it to finance the creation of public assets.

This bank will be 100% owned by the State, and chartered to act exclusively as the State’s bank.

It will participate in the commercial bank clearing system. It will be additional to the Bank of England, which will continue to function as at present.

HOW A SEIGNIOR BANK WILL WORK

Instead of the Treasury issuing government bonds (which are, in effect, government IOUs to the banking system) the Treasury will issue Treasury Credits to the Seignior Bank.

These “Treasury Credits” will be denoted in sterling — and be equivalent to the National Currency.

They will be legal tender in the hands of the commercial banks and have the same status as coin and paper of the Realm.

The same security which renders government bonds ‘as good as gold’ endows the same credibility upon the government’s issue of “Treasury Credits” to the Seignior Bank.

As Thomas Edison said: “If our nation can issue a dollar bond, it can issue a dollar bill. The element that makes the bond good makes the bill good … It is absurd to say that our country can issue $30,000,000 in bonds and not $30,000,000 in currency.” [Quoted in The New York Times, 6 December 1921]

The “Treasury Credits” will be equivalent to the notes and coins to which Edison refers.

This money will only be available for government backed projects. It should be regarded as a supplement to taxation income.

Just as seigniorage on newly issued cash is credited to the Public Account, so are “Treasury Credits” — both are money in the hands of the public and the banks.

HOW THIS MONEY WILL ENTER SOCIETY

Say, for example, the government says, “We need £1 billion pounds to pay the contractors to build new hospitals.”

The Treasury will create £1 billion in “Treasury Credits” and lodge them with the Seignior Bank.

The money will move from the Seignior Bank, into society in the following manner.

The appropriate Government Department will write a cheque to pay a particular contractor.

The cheque is drawn on the Seignior Bank.

The contractor then takes it along to his own bank, and pays it into his private bank account. The cheque is then cleared through the Association for Payment Clearing (APAC) system, as usual.

The private bank is paid in the “Treasury Credits” which are, in all respects, equal to cash, and the contractor’s private bank account is credited with the appropriate amount in sterling.

Administered responsibly, just as the State has issued debt certificates and debt-free cash responsibly for donkey’s years, the ability of Government to create its own debt-free money could create real economic activity, employment and wealth.

This would go a long way towards eliminating the present anomaly of the nation’s unemployed human and material resources stagnating due to a lack of money. We could dispense with the eternal ‘either or’ debate and start work on the tasks and desirable projects currently awaiting public funding.

If we ever did get back to the two or three per cent unemployment of the fifties and early sixties, that would be time enough to debate the ‘either or’ priorities again.

The State would also have the ability, or “discretion”, to intervene on those not infrequent occasions when the private financial sector overheats and needs to contract its lending to protect its shareholders from a perceived risk.

HOW MUCH SHOULD BE CREATED?

The conservative view might be to argue that the volume of money to be created should relate to no more than the loss of past seigniorage, calculated back to an arbitrary date, say 1960, when the ‘natural’ rate of seigniorage started to decline.

This could be released progressively and thereafter new money would be linked to the Bank of England’s assessment of the annual increase in the total volume of commercial bank credit which would have been projected for the coming year.

James Robertson and Joseph Huber calculated in their book Creating New Money (See Prosperity, August 2000) that the loss of seigniorage — that is, the loss of the value of the new money which would otherwise have been credited to the public purse — costs the UK government around £49bn per annum.

This might be a good guide to the amount of new State money to be created initially.

However, it’s easy to be obsessed with numbers and the ‘amount’ of new money to be created.

The right amount is sufficient to finance that which is socially desired but insufficient to devalue spending power and induce inflation.

There is no formula for this, any more than there is a formula for the amount of bank credit which currently provides 97% of our money supply. Given adherence to its Charter and the over-riding stability imperative, the extent of the Seignior Bank’s money creating powers would be reviewed, having regard to any surplus or shortfall in the Nation’s human and natural resources.

Thus would government find the money to finance the public sector and, given responsible management, maybe even reduce taxation and give a boost to the real economy.

COMMERCIAL BANK SYSTEM COULD BE LEFT AS IS

The commercial banks may not appreciate losing their monopoly on the annual round of increasing Bank Created Credit to the new Seignior Bank.

However, there may not be any need to restrict the traditional credit creating power of the commercial banks.

They create credit according to demand, and the amount of that credit is limited by the normal banking constraints of security and repayment.

Moreover, there is likely to be additional economic activity created by increased public spending which will compensate them to an extent.

No doubt the banks would prefer to lend new credit at interest to the Private Finance Initiatives and Partnerships virtually secured on government bonds — but there will now be no need for such schemes, and the banks will just have to accept the loss of that particular profit-making opportunity.

BENEFITS OF BREAKING THE BANKING MONOPOLY

Monetary reform of this nature is prompted by a desire to re-establish a reasonable public sector presence in a mixed economy.

If the new debt-free income is not used for additional public investment then the social benefits will not accrue. If, for example, the new debt-free income is simply offset by an equivalent private sector tax cut then all will have been in vain and nothing new will have been created.

There is a good argument that the nature of this investment should be precisely defined. It is easy to make the case for public buildings and infrastructure, perhaps less so for investment in ‘social’ capital, ie training more doctors, teachers and nurses or increasing certain social security benefits. This will require some basis in legislation and is perhaps also a constitutional matter for the judiciary.

In the final analysis, it is the administration which the voters empower which will make the decisions, not the unelected bankers.

A Bill to break the monopoly of the banks and establish a State Bank would spark a debate which would lay bare the stranglehold the banks hold over public investment.

Perhaps the most important side effect would be to stymie the ambitions of huge financial and multi-national conglomerates to reduce democratic government to their own private puppet show.

The discovery that there might indeed be another way to run an economy may be sufficient to bring back the apathetic, who absent themselves in increasing numbers from the voting process.

Understanding the potential of Monetary Reform is only one factor in helping the honest politician resist the corruption of Money Power.

There is bound to be resistance to such changes, but managing the monetary system must be effected in the interest of the Nation. Given the will, there is no shortage of money for public services.

Date: June 19, 2010

Categories: Articles

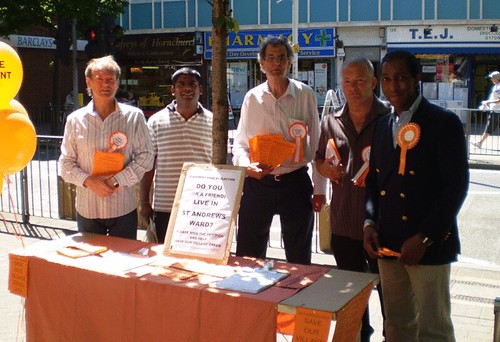

National Liberal supporters were out in Hornchurch today promoting the NLP candidate David Durant for a forthcoming by-election in London borough of Havering.

National Liberal supporters were out in Hornchurch today promoting the NLP candidate David Durant for a forthcoming by-election in London borough of Havering.