WILLS & BEQUESTS

–

Why you should make a Will

When you die your affairs must be ‘wound up’. There are likely to be outstanding bills and funeral expenses to be met from your estate – that is to say, all the property owned by you at your death. Making a Will simplifies all this.

A Will is the only way to ensure that whatever you leave is distributed to people, organisations or charities, in accordance with your wishes and with the minimum delay.

Without a Will, the fate of your assets after the payment of outstanding liabilities is defined by law. Part passes to your surviving spouse and the remainder to your children. If you have no children then a share of your estate passes to your parents (if they are alive) or other relatives – friends cannot benefit – nor can charities or organisations. Don’t forget that your estate includes your house. Unless your partner jointly owns this with you, he or she will not automatically inherit it on your death, and could even be forced to move.

Furthermore, your relatives may on your death spend some time searching for a Will if they cannot be sure you did not make one. This could delay the winding up of your estate quite considerably and cause distress at an already stressful time.

When you should make a Will

As soon as you are of age and have possessions which you may dispose of you should make a Will. To put it off may lead to difficulties for your family later.

You may well need to alter your Will as your circumstances change, but this can be done very simply with legal help by adding a ‘codicil’. You must make a new Will if you get married, as marriage automatically revokes any existing Wills. Similarly, if you get divorced you should think about making a new Will. For someone who is married or has a family it is absolutely vital that a Will is made. Both husband and wife should make separate Wills.

How to make a Will

Most important of all, see a Solicitor or contact us and we will help. While it is possible for you to “do it yourself” using a Will form, this is not recommended.

Your intentions may be very simple, but the legal formalities and language required are complicated and need to be strictly followed. Scots law gives the spouse and children certain rights to a deceased person’s estate, and these have to be considered when a Will is made.

Just a minor difference in wording could make a major difference so far as the law is concerned.

Before you visit a Solicitor or contact us it will be helpful if you are prepared. Here are a few things you should do:

Make an estimate of the value of your assets.

List the names of people, organisations and charities you wish to benefit; it is important to get the names correct and spell them out in full. If you are not certain about our correct title or address please print this out and let your Solicitor see the text in order to include the full correct details.

Decide who are to receive cash legacies, and the amounts they are to have, and who will receive gift of residue.

List any specific items of personal property and the people you wish to leave them to.

Decide who you wish to be your Executors. Their names and addresses have to be spelt out in full. You can choose anyone you like, but the administration of your estate can be time-consuming and tricky, so it is helpful to include a Solicitor among them. If you have children who minors, name Guardians too.

List any property you hold jointly and anything held in trust for you.

Produce any earlier Will, if you have one.

Write down any questions you may need to ask relating to your estate.

Decide if you wish to include instructions about cremation or burial in your Will.

Leaving a Legacy to the National Liberal Party

Bequests to organisations can be made in just the same way as gifts to individuals. They can take the form of specific gifts of money or possessions. There are three easy ways to include the National Liberal Party in a new Will: a residuary legacy, a pecuniary legacy and a specific legacy.

1. Residuary legacy

What does it mean? This is a gift of the remainder or percentage of your estate after all other legacies have been made and debts cleared.

–

Residuary legacies are an effective way to divide the value of an estate between a number of people and causes that are important to you.

–

Suggested wording: “I GIVE the whole of my estate or X per cent of the residue of my estate after payment of my funeral and testamentary expenses and debts and all legacies given by this my Will or any codicil hereto and all inheritance tax payable upon or by reason of my demise to my [Executor(s)/Trustees] UPON TRUST for the National Liberal Party of PO Box 4217, Hornchurch, Essex RM12 4PJ.. I confirm that I am on the electoral register in the UK (excluding the Channel Islands and the Isle of Man) at the time of signing this Will.”

–

2. Pecuniary legacy

–

What does it mean? A gift of a fixed sum of money.

–

Suggested wording: “I GIVE to the National Liberal Party of PO Box 4217, Hornchurch, Essex RM12 4PJ, the sum of XX pounds [sum in words] £XX [sum in figures] free of Inheritance Tax for its general purposes and I direct that the receipt of the Treasurer for the time being shall be sufficient discharge to my [Executor(s)/Trustees]. I confirm that I am on the electoral register in the UK (excluding the Channel Islands and the Isle of Man) at the time of signing this Will.”

–

3. Specific legacy

–

What does it mean? A particular named item left as a gift in your Will is known as a specific legacy, for example, a piece of jewellery.

Suggested wording: “I GIVE to the National Liberal Party of PO Box 4217, Hornchurch, Essex RM12 4PJ., for its general purposes free of Inheritance Tax and other fiscal impositions and costs of transfer my [description of the item] for its general purposes absolutely and I direct that the receipt of the Treasurer for the time being shall be sufficient discharge to my [Executor(s)/Trustees]. I confirm that I am on the electoral register in the UK (excluding the Channel Islands and the Isle of Man) at the time of signing this Will.”

–

Recommended Additional Paragraph

–

If you decide to remember the National Liberal Party in your Will we also recommend taking the following paragraph to your solicitor. It is important that the following clause is included in your Will, whichever type you choose:

“If at my death any charity or organisation named as a beneficiary in this Will or any Codicil hereto has changed its name, amalgamated with or transferred its assets to another body, or changed its address, then my executors shall give effect to any gift made to such charity or organisation as if it had been made (in the first case) to the body in its changed name or (in the second place) to the body which results from such amalgamation or to which such transfer has been made or (in the third case) to the organisation based at their new address.”

Ensure you are on the Electoral Register

Under UK Legislation we will only be able to receive funds left to us in a Will, if that person had been on a UK electoral register during the five years before their death.

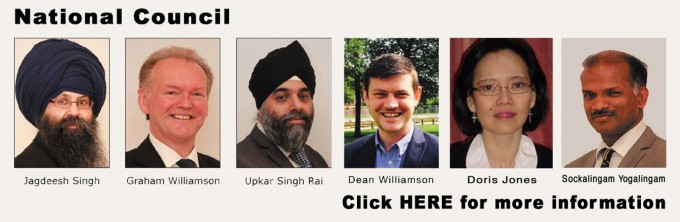

If you are one of the people who have remembered the National Liberal Party in their Will, please make sure you are also on the electoral register. Just call your Town Hall and ask to speak to the Returning Officer if you are in any doubt. You should also contact us to inform us of your bequest and provide details of your executors. We can also arrange for a senior Party member to visit you and discuss matters in confidence and act as an Executor if required. Just E-mail natliberal@aol.com or write to The Treasurer, PO Box 4217, Hornchurch, Essex RM12 4PJ.

You can also add a codicil to your existing Will. That is a simple way of adding a gift to the National Liberal Party if you have already made a Will. Just E-mail natliberal@aol.com and we will send you a form.

If you have already made a Will, it should be regularly reviewed and updated if necessary.

It is easy to make simple changes, such as adding a legacy. Your Solicitor will draw up an amendment form called a ‘codicil’ and this will be placed in your Will. Alternatively we can help if you contact us.

If you marry, remarry, separate, divorce or are widowed you will usually need to draw up a new Will.

Ensure you are on the Electoral Register

Under UK Legislation we will only be able to receive funds left to us in a Will, if that person had been on a UK electoral register during the five years before their death.

If you are one of the people who have remembered the National Liberal Party in their Will, please make sure you are also on the electoral register. Just call your Town Hall and ask to speak to the Returning Officer if you are in any doubt. You should also contact us to inform us of your bequest and provide details of your executors. We can also arrange for a senior Party member to visit you and discuss matters in confidence and act as an Executor if required.

Why a legacy is so important to National Liberal Party

The promise of a legacy gives us a good idea of money which will be available for our work in the future. It is a very special way of giving; many people cannot afford large sums in their lifetime but can make a significant and far-reaching contribution through their Will.

Date: February 25, 2008